Oct 19, 2023

Cryptocurrencies have emerged as a groundbreaking phenomenon in the ever-evolving world of finance and technology. The term "cryptocurrency" itself carries a certain mystique, conjuring images of a digital gold rush. In this comprehensive guide, we will delve into the world of cryptocurrencies, explore the myriad types of cryptocurrencies that exist, and focus on the standout player in the field, Bitcoin. Whether you are a seasoned crypto enthusiast or a curious newcomer, this article will provide valuable insights, relevant information, and actionable tips to enhance your understanding. Let's embark on this exciting journey through the world of Bitcoin and important cryptocurrencies.

Cryptocurrencies have disrupted traditional financial systems and captivated the world's attention in recent years. These digital assets have gained immense popularity, but what exactly are cryptocurrencies, and why do they matter?

What are Cryptocurrencies?

Cryptocurrencies are digital or virtual currencies that use cryptography for security. Unlike traditional currencies issued by governments and central banks, cryptocurrencies are decentralized and operate on a technology called blockchain. A blockchain is a distributed ledger that records all transactions across a network of computers, ensuring transparency and immutability

Difference between Coins & Tokens

Before diving into the diverse world of cryptocurrencies, it's crucial to understand the difference between coins and tokens.

-

Coins: Coins are standalone digital currencies with their own blockchain. Bitcoin (BTC) is the most famous example of a cryptocurrency coin. Coins typically serve as a medium of exchange, store of value, and unit of account.

-

Tokens: Tokens, on the other hand, are built on existing blockchain platforms like Ethereum. They represent assets or utilities and can be used for various purposes within a specific ecosystem. Tokens include non-fungible tokens (NFTs), utility tokens, and security tokens.

Why are there so many types of cryptocurrency?

The cryptocurrency landscape is vast and diverse, with thousands of cryptocurrencies in existence. The proliferation of cryptocurrencies can be attributed to several factors:

-

Innovation: The blockchain technology that underpins cryptocurrencies has evolved, allowing developers to create new and innovative cryptocurrencies.

-

Diverse Use Cases: Cryptocurrencies cater to a wide range of use cases, from digital cash (Bitcoin) to smart contracts (Ethereum) and stablecoins (Tether).

-

Global Adoption: As cryptocurrencies gain popularity, more individuals and businesses are entering the space, leading to the creation of new cryptocurrencies.

-

Market Demand: Investors and traders seek opportunities in different types of cryptocurrencies, leading to the emergence of altcoins (alternative coins).

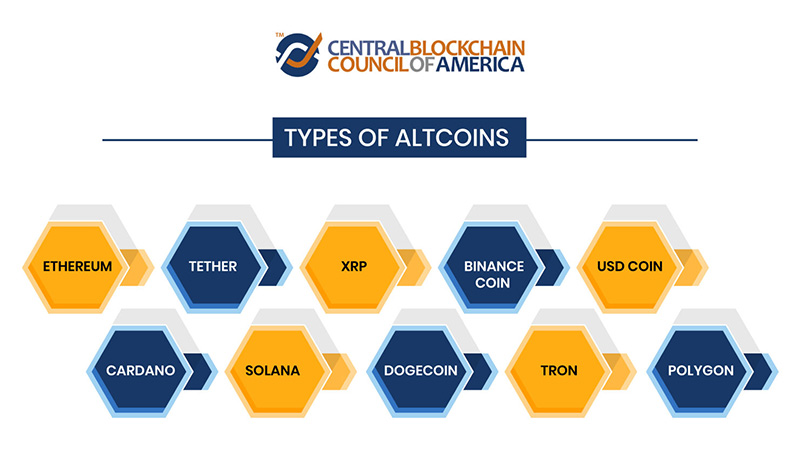

Types of Altcoins

Altcoins, short for "alternative coins," are any cryptocurrencies other than Bitcoin. They represent a diverse array of digital assets that have emerged in the wake of Bitcoin's success. While Bitcoin serves primarily as a decentralized digital currency and store of value, altcoins encompass a wide range of functions and use cases. Altcoins often differentiate themselves by offering innovative features, technologies, and applications. Some serve as platforms for creating smart contracts and decentralized applications (e.g., Ethereum), while others focus on stable value (e.g., Tether) or rapid transaction processing (e.g., Solana). These distinctions make altcoins unique in their offerings and potential, setting them apart from the pioneering Bitcoin. Here are ten notable altcoins, along with their tickers, market capitalization, and brief descriptions:

-

01. Ethereum

Ticker: ETH-USD

Market Cap: $189.60B

Description: Ethereum is a decentralized platform that enables the creation of smart contracts and decentralized applications (DApps). It is often considered the pioneer of blockchain-based smart contracts.

-

02. Tether

Ticker: USDT

Market Cap: $83.208B

Description: Tether is a stablecoin pegged to the value of a fiat currency, typically the US dollar. It provides stability in the volatile cryptocurrency market.

-

03. XRP

Ticker: XRP

Market Cap: $27.35B

Description: XRP is the native cryptocurrency of the Ripple network, which aims to facilitate fast and low-cost cross-border payments.

-

04. Binance Coin

Ticker: BNB

Market Cap: $32.21B USD.

Description: Binance Coin is the native cryptocurrency of the Binance exchange and is used for various purposes, including trading fee discounts.

-

05. USD Coin

Ticker: USDC

Market Cap: $25.712B

Description: USD Coin is another stablecoin, providing a digital representation of the US dollar and used for trading and transactions.

-

06. Cardano

Ticker: ADA

Market Cap: $8.55B

Description: Cardano is a blockchain platform known for its focus on sustainability, scalability, and interoperability.

-

07. Solana

Ticker: SOL

Market Cap: $8.033B

Description: Solana is a high-performance blockchain platform known for its fast transaction speeds and low fees.

-

08. Dogecoin

Ticker: DOGE

Market Cap: $8.68B

Description: Dogecoin started as a meme cryptocurrency but has gained popularity as a digital tipping currency and a symbol of the crypto community's humor.

-

09. Tron

Ticker: TRX

Market Cap: $7.5B

Description: Tron is a blockchain platform focused on decentralized entertainment and content sharing.

-

10. Polygon

Ticker: MATIC

Market Cap: $4.80B

Description: Polygon is a Layer 2 scaling solution for Ethereum, aiming to improve its scalability and reduce transaction costs.

These altcoins represent just a fraction of the diverse cryptocurrency ecosystem. Each has its unique features, use cases, and communities

What Is Bitcoin?

Bitcoin, often referred to as digital gold, is the first and most well-known cryptocurrency. It was created in 2009 by an individual or group using the pseudonym Satoshi Nakamoto. Bitcoin's primary purpose is to serve as a decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries like banks.

Bitcoin's Blockchain Technology

Bitcoin's blockchain is the foundation of its success. It operates as a decentralized ledger that records all transactions in a transparent and tamper-resistant manner. Key features of Bitcoin's blockchain include:

-

Decentralization: Bitcoin's blockchain is maintained by a distributed network of nodes, making it resistant to censorship and control by any single entity.

-

Security: Cryptography ensures the security of Bitcoin transactions and the integrity of the blockchain.

-

Immutability: Once a transaction is recorded on the Bitcoin blockchain, it cannot be altered or deleted, providing a permanent record of all transactions.

What is Bitcoin Mining: How to Earn Bitcoin?

Bitcoin mining is the foundational process that underpins the security and functionality of the Bitcoin network. It is a decentralized mechanism through which new Bitcoins are created and transactions are validated and added to the blockchain, which is essentially the public ledger of all Bitcoin transactions. In simple terms, miners act as the network's auditors, ensuring the integrity of transactions while also being rewarded for their efforts.

Better Healthcare

Blockchain-based electronic health records could give healthcare providers a more holistic view of patient data and improve health outcomes. It would also rebalance information paradigms and place the 'personal' in personal health. In addition, blockchain in healthcare can ensure transparency and honesty in developing pharmaceutical drugs with a long-winded process that requires stringent checks for data integrity or hygiene.

The Mining Process:

-

Complex Mathematical Puzzles: Miners employ powerful computer systems, often consisting of specialized hardware known as ASICs (Application-Specific Integrated Circuits), to solve intricate mathematical puzzles. These puzzles, known as Proof of Work (PoW), require miners to find a specific numeric value (a nonce) that, when hashed with the data from a block of pending transactions, produces a hash with certain characteristics (usually starting with a certain number of zeros).

-

Competition for Validation: Bitcoin operates on a decentralized network of miners worldwide. Each miner competes to be the first to solve the PoW puzzle for a new block of transactions. This competition is intense and operates on a first-come, first-served basis.

-

Block Validation: The miner who successfully solves the puzzle broadcasts their solution to the network. Other miners then verify the solution, ensuring its correctness. Once consensus is reached, the new block is added to the blockchain, and the winning miner receives the right to add a block of transactions.

Earning Bitcoin:

In return for their efforts in securing the network and validating transactions, miners are rewarded with two primary forms of compensation:

-

Block Rewards: Miners are granted a fixed number of newly created Bitcoins for every block they successfully mine. This serves as the mechanism through which new Bitcoins are introduced into circulation. Initially, the reward was 50 Bitcoins per block, but this amount undergoes a "halving" event approximately every four years, reducing the reward by half. The most recent halving, for instance, reduced the reward to 6.25 Bitcoins per block.

-

Transaction Fees: In addition to block rewards, miners also collect transaction fees from users who wish to have their transactions included in the next block. These fees incentivize miners to prioritize transactions with higher fees, ensuring the efficient processing of transactions within the network. Transaction fees serve as an additional source of income for miners.

Challenges and Considerations:

Mining is not without its challenges. It requires a significant investment in specialized hardware, which can be expensive, and consumes a substantial amount of electricity due to the computational power needed to solve PoW puzzles. Furthermore, Bitcoin mining has become highly competitive, with large mining pools combining their computational resources to improve their chances of successfully mining blocks. This competition can make it challenging for individual miners to earn rewards. Bitcoin mining is a critical process that ensures the security and decentralization of the Bitcoin network. Miners play a pivotal role in validating transactions and adding them to the blockchain, while also being rewarded with newly created Bitcoins and transaction fees. However, it's essential to recognize that Bitcoin mining has evolved into a competitive industry, demanding substantial investments in hardware and energy resources.

How to Buy Bitcoin?

Purchasing Bitcoin is relatively straightforward and can be done through cryptocurrency exchanges or peer-to-peer platforms. Here's a simplified process:

-

Choose a Wallet: Start by selecting a secure cryptocurrency wallet to store your Bitcoin.

-

Select an Exchange: Sign up on a reputable cryptocurrency exchange like Coinbase, Binance, or Kraken.

-

Verify Your Identity: Most exchanges require identity verification for security and regulatory compliance.

-

Deposit Funds: Deposit fiat currency (e.g., USD, EUR) into your exchange account.

-

Place an Order: Use your deposited funds to place an order to buy Bitcoin at the current market price or set a specific price

-

Secure Your Bitcoin: After purchase, transfer your Bitcoin to your secure wallet for added security.

How Is Bitcoin Used?

Bitcoin has evolved beyond a digital currency and is now used in various ways:

-

Digital Gold: Many investors view Bitcoin as a store of value and a hedge against inflation, similar to gold.

-

Payments: Some merchants accept Bitcoin as a form of payment for goods and services.

-

Remittances: Bitcoin facilitates cross-border remittances, enabling faster and cheaper transactions.

-

Investment: Traders and investors buy and hold Bitcoin as an investment, hoping its value will appreciate over time.

-

Speculation: Bitcoin is often subject to speculative trading, with traders aiming to profit from price fluctuations.

Why Is Bitcoin Still the Most Important Cryptocurrency?

Despite the proliferation of altcoins and the emergence of diverse blockchain projects, Bitcoin remains the cornerstone of the cryptocurrency space for several reasons:

-

First-Mover Advantage: As the first cryptocurrency, Bitcoin has established itself as a trusted and widely recognized digital asset.

-

Store of Value: Bitcoin's limited supply (21 million coins) and decentralization make it an attractive store of value, especially during economic uncertainties.

-

Network Security: Bitcoin's robust and secure network has never been compromised since its inception.

-

Liquidity: Bitcoin is the most liquid cryptocurrency, with the highest trading volumes and market capitalization.

-

Recognition: Institutional investors and governments have started recognizing and integrating Bitcoin into their financial systems.

-

Decentralization: Bitcoin's decentralized nature makes it resistant to censorship and control by any single entity.

Conclusion

Cryptocurrencies have redefined the way we perceive and use money. From the vast landscape of altcoins to the revolutionary potential of Bitcoin, the world of cryptocurrencies is filled with opportunities and challenges. Whether you're a seasoned crypto enthusiast or a curious newcomer, understanding the fundamentals of cryptocurrencies and their implications for the future of finance is essential. As this space continues to evolve, staying informed and making informed decisions is key to harnessing the benefits of this transformative technology.

Intrigued by cryptocurrencies? Dive deeper into this exciting world, explore the various types of cryptocurrencies, and consider Bitcoin's enduring importance in shaping the future of finance.